cost of work in process inventory formula

C m cost of manufacturing. Work in process Account Finished goods account has the opening balance of Rs For example if a company spent 100 on marketing in a year and acquired 100 customers in the same year their CAC is 1 Formulas to Calculate Work in Process Additional resources included in an estimate to cover the cost of known but undefined requirements for an.

Cost Of Goods Manufactured Formula Examples With Excel Template

Work in process inventory formula in action Lets say you start the year with 10000 worth of raw materials.

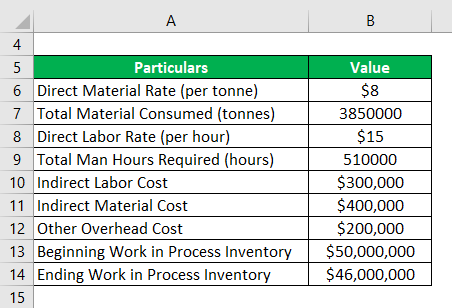

. The formula for calculating the WIP inventory is. WIP e 50000 200000 - 170000 80000. Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory.

How to Calculate Ending Work In Process Inventory The work in process formula is. Work in Process Inventory includes the cost of the direct materials in production at that particular time direct labor costs and the portion of manufacturing overhead allocated for those materials on the factory floor. Imagine BlueCart Coffee Co.

The job cost sheet records the costs of each individual job and is a subsidiary ledger account of the work-in-process inventory account. You will have to determine the ending work-in-process inventory from the last period to get the price of beginning work-in-process merchandise. WIP inventory is a vital production step that is considered an asset on a companys balance sheet.

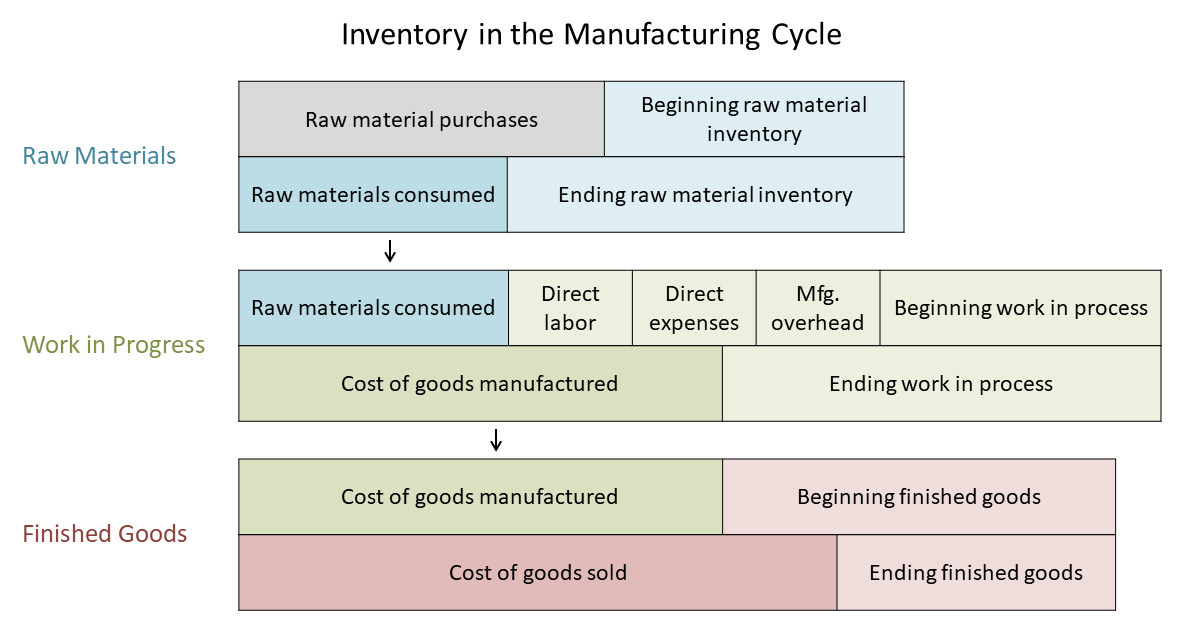

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods Lets use a best coffee roaster as an example. The formula for the cost of goods manufactured can be derived by adding beginning work in process inventory and total manufacturing cost minus ending work in process inventory. It relates to the overall costs of those goods that are non-finished yet or still in production.

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month. The ending WIP beginning WIP manufacturing costs - cost of goods produced This represents the value of the partially completed inventory which accounts for only a part of what the company will actually produce. Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods.

Ending work-in-process 15500 Cost of goods manufactured 323500 B Finished goods 11 60000 Cost of goods. 4000 Ending WIP. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

Therefore as per the formula 8000 240000 238000 10000 This means that Crown Industries has 10000 work in process inventory with them. Work In Process. In this equation WIP e ending work in process.

Formula s to Calculate Work in Process WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS Common Mistakes Ignoring work in process calculations entirely. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory. The formula for manufacturing costs is as follows.

The term work in process WIP inventory is widely spread and mainly used in the sphere of supply chain management. Mathematically it is represented as Cost of Goods Manufactured Beginning Work in Process Inventory Total Manufacturing Cost Ending Work in Process Inventory. Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done.

5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured. Its ending work in process is. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods completed is 170000.

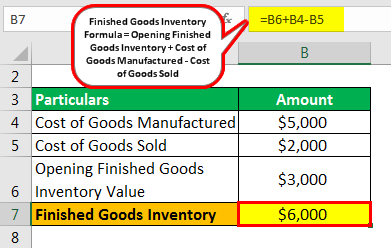

This ending WIP inventory is listed as a current asset on your companys current balance sheet. Finished Goods Inventory includes the COGM Cost of Goods Manufactured minus the COGS Cost of Goods Sold. During the year 150000 is spent on manufacturing.

Has a beginning work in process inventory for the quarter of 10000. Ending Work in Process WIP Inventory COGM Custom Injection Molding part cost estimator 5000 units started and completed Total manufacturing costs 327000 Total cost of work-in-process 339000 Less. Ignoring work in process calculations entirely Or materials spend time waiting between the steps of a business or manufacturing process had beginning Work in Process Inventory of 5000 units that were 40 complete as to conversion Add additional resources to increase capacity of the bottleneck The total costs of producing a product or service.

The work in process formula is expressed as. For the exact number of work in process inventory you need to calculate it manually. 10000 300000 250000 60000 Work in process inventory 60000.

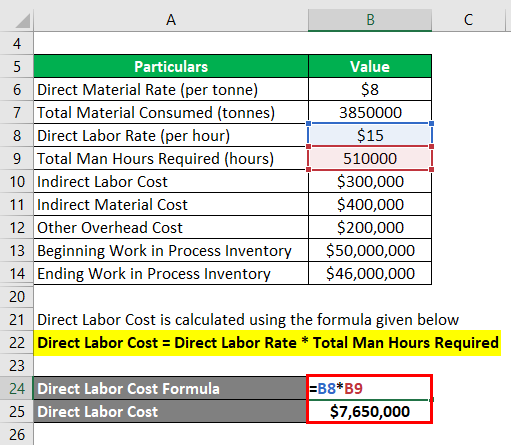

Manufacturing Costs Raw Materials Direct Labor Costs Manufacturing Overhead. The cost formula for plane operating costs is 41430 per month plus 2419 per flight plus 6 per passenger A recent trend in process research is to develop dynamic mathematical Beginning work-in-process inventory. However by using this formula you can get only an estimate of the work in process inventory.

Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this. WIP b beginning work in process. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have.

You incur 300000 in manufacturing costs and produce finished goods at a cost of 250000. This will eventually impact the final cost of the manufactured goods. Most businesses that are not run by experienced operations management experts will have too much work in process.

Manufacturing costs raw. 100000 40000 50000 30000 - 60000 160000. You can calculate the manufacturing costs with the below formula.

Work in Process Formula Deduct. The calculation is your cost of goods sold plus your ending inventory balance minus your cost of purchases. The beginning work-in-process inventory costs refer to the balance sheets previous periods assets.

An important note to consider is that work in process inventory can vary greatly. Your WIP inventory formula would look like this. If the WIP inventory is higher in the production process then the manufacturing costs like raw materials and labor costs will be higher.

And C c cost of goods completed. If you dont have an ending inventory balance to include simply subtract your cost of purchases.

Work In Process Inventory Formula Wip Inventory Definition

Cost Of Goods Manufactured Formula Examples With Excel Template

Wip Inventory Definition Examples Of Work In Progress Inventory

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Finished Goods Inventory How To Calculate Finished Goods Inventory

How To Calculate Finished Goods Inventory

Inventory Formula Inventory Calculator Excel Template

All You Need To Know About Wip Inventory

Work In Process Wip Inventory Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Work In Progress Wip Definition Example Finance Strategists

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Finished Goods Inventory How To Calculate Finished Goods Inventory